Investing in Wine: Understanding the Fine Wine Market

Author : Pavan Kumar | Published On : 17 Apr 2024

Investing in fine wine can be an attractive option for investors seeking diversification and potential returns. Understanding the fine wine market is crucial for making informed investment decisions.

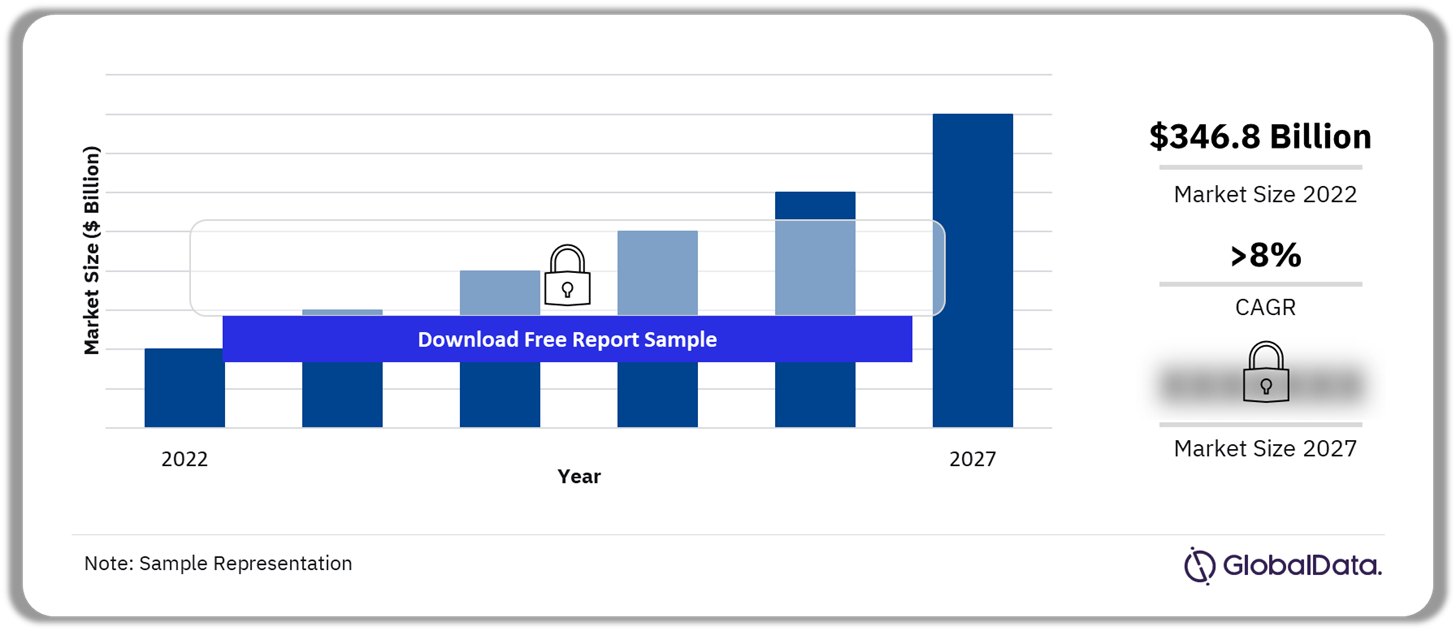

Buy the Full Report for Wine Market Forecasts

Here are key factors to consider:

-

Market Fundamentals: Fine wine is a tangible asset with unique market fundamentals influenced by supply and demand dynamics, quality assessments, vintage variations, and producer reputations. Understanding market trends, pricing trends, and auction results can provide insights into investment opportunities and market sentiment.

-

Quality and Rarity: Fine wine investment focuses on high-quality, rare, and collectible wines from prestigious wine regions, producers, and vintages. Wines with provenance, aging potential, and critical acclaim tend to command higher prices and appreciation over time.

-

Wine Regions and Producers: Investing in fine wine often involves focusing on renowned wine regions such as Bordeaux, Burgundy, Napa Valley, and Tuscany, known for producing wines with investment potential. Researching top producers, vineyards, and appellations can help identify quality wines with investment appeal.

-

Vintage Variation: Vintage variation plays a significant role in fine wine investment, as weather conditions and grape quality vary from year to year. Investing in top vintages characterized by optimal growing conditions, balanced ripeness, and aging potential can enhance investment returns and minimize risks associated with poor vintages.

-

Wine Storage and Provenance: Proper wine storage and provenance are essential considerations for fine wine investors to preserve wine quality, authenticity, and value. Investing in professionally managed storage facilities with temperature and humidity control ensures wine integrity and maintains investment value.

-

Market Liquidity and Accessibility: The fine wine market offers various avenues for buying and selling wine, including wine merchants, auction houses, wine investment funds, and online trading platforms. Understanding market liquidity, transaction costs, and accessibility can influence investment strategies and liquidity management.

-

Investment Horizon and Risk Management: Fine wine investment typically requires a medium to long-term investment horizon to realize potential returns, as wine appreciation occurs over years or decades. Investors should assess risk factors such as market volatility, currency fluctuations, counterparty risks, and regulatory considerations when formulating investment strategies.

-

Diversification and Portfolio Allocation: Fine wine investment should be part of a diversified investment portfolio, complementing other asset classes such as stocks, bonds, real estate, and commodities. Allocating a portion of the investment portfolio to wine can mitigate portfolio risk and enhance overall returns through asset diversification.

-

Due Diligence and Expert Advice: Conducting thorough due diligence and seeking expert advice from wine professionals, investment advisors, and financial planners is essential for navigating the complexities of the fine wine market. Understanding investment risks, tax implications, legal considerations, and valuation methodologies can help investors make informed decisions.

-

Legal and Regulatory Considerations: Fine wine investment involves legal and regulatory considerations related to taxation, import/export regulations, storage insurance, and compliance with local laws. Investors should consult legal experts and tax advisors to ensure compliance with relevant regulations and minimize legal risks.

By understanding the nuances of the fine wine market and conducting comprehensive research and due diligence, investors can potentially capitalize on investment opportunities and build a diversified portfolio with the potential for attractive returns over the long term.