Gold’s Rollercoaster: Why Prices Surged to Record Highs and What’s Next for Investors

Author : Rits Capital | Published On : 30 Oct 2025

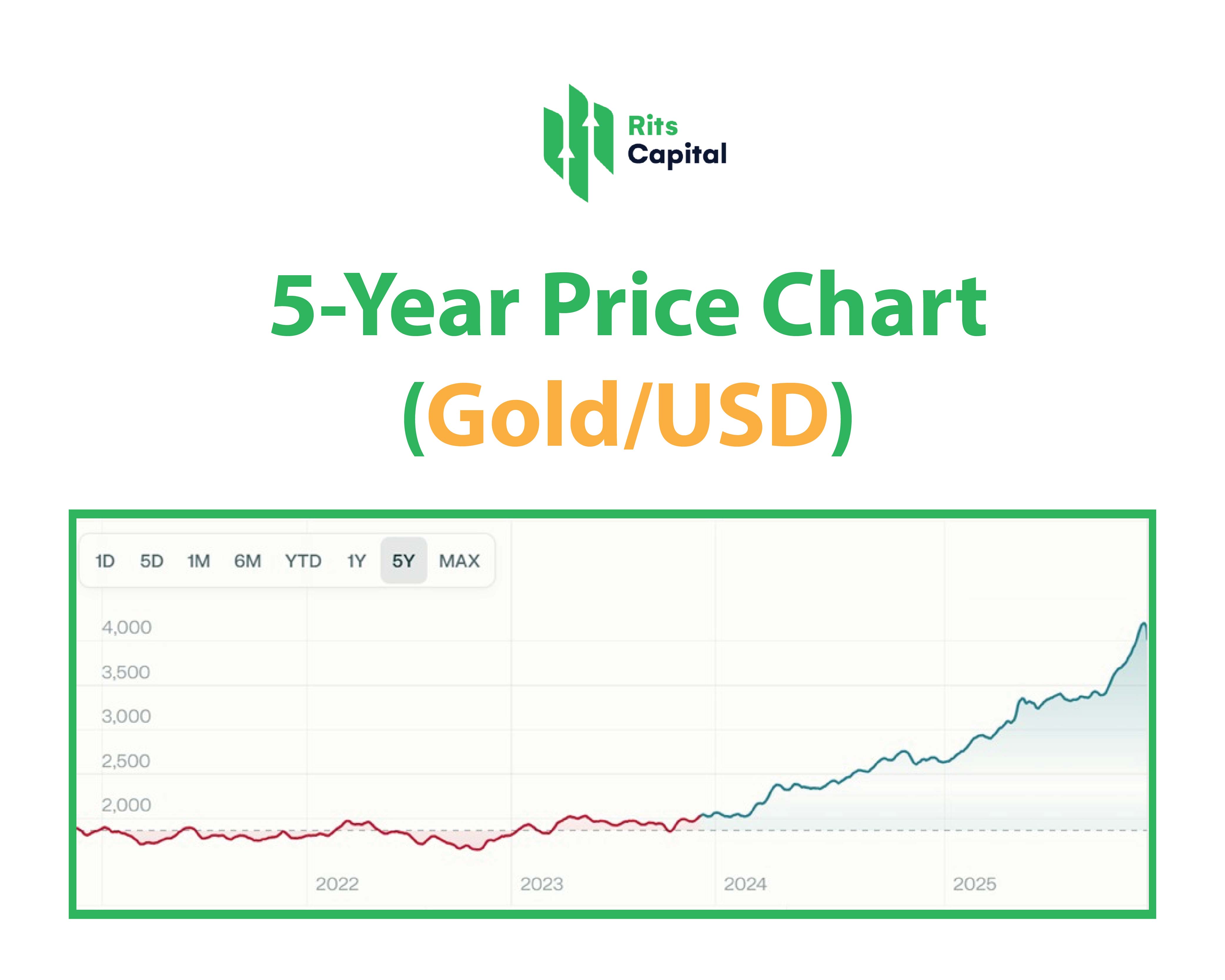

Gold, the timeless symbol of wealth and security has once again captured the spotlight. Over the past few months, prices have soared to historic highs, briefly crossing $4,000 per ounce in October 2025, before showing signs of cooling.

For investors across the globe the question now is simple: what’s driving these swings, and where do we go from here?

The Golden Surge: What Just Happened?

| Metric | Latest Value | Context |

| Spot Gold (USD/oz) | Approx. $4,000+ | A new all-time high. |

| YTD Gain (2025) | +45%–50% | One of the strongest years in two decades |

| India Gold Price | ₹1,00,000+ per 10g | Record domestic high |

| Recent Dip | −3–4% | Triggered by renewed “risk-on” sentiment and stronger USD |

For most of 2025, gold was on a tear a near-perfect storm of economic uncertainty, softer dollar, and record central-bank buying drove prices up. But like every rally, it’s meeting short-term resistance.

Why Gold is Shining So Bright?

Let’s decode the forces behind this rally in simple, human terms:

1. The Dollar Lost Its Shine

When the U.S. dollar weakens, gold priced in dollars becomes cheaper for global buyers. With the Federal Reserve hinting at rate cuts in 2026, investors started piling into gold instead of cash.

2. The World Feels Riskier

From geopolitical tensions to election-year uncertainty, investors sought safety. Historically, gold thrives when anxiety rises and 2025 has had plenty of that.

3. Central Banks are Stacking Gold

Major economies from China to Poland have ramped up their gold reserves. The World Gold Council reports that central-bank buying hit a multi-year high, signalling deep distrust of fiat stability.

4. Inflation’s Shadow Still Looms

While inflation is cooling, real interest rates remain low. For a non-yielding asset like gold, that’s bullish the “opportunity cost” of holding gold is small.

Source: Perplexity

Read Also: How Modern Technology is Transforming Bookkeeping in 2025

Why Prices Dipped Briefly?

No rally is linear. The recent dip was a classic case of “risk-on” optimism.

- U.S.–China trade optimism lifted market mood → gold demand eased.

- Profit-booking after a 45% YTD surge.

- Technical correction: traders took cues from overbought indicators.

P.s- But here’s the good news most analysts, from J.P. Morgan to Bank of America, see these dips as healthy pauses, not trend reversals.

What’s Next: Should You Buy Now?

Think of gold not as a “quick win,” but as a strategic insurance policy in your portfolio.

Here’s a simple framework we use at Rits Capital:

| Scenario | Ideal Action | Why |

| Gold dips below $3,600 | Gradually accumulate | Long-term tailwinds intact |

| Gold near $4,500-$5,000 | Hold / rebalance | Avoid chasing highs |

| Global inflation spikes again | Increase allocation | Protect real returns |

Gold doesn’t promise returns — it promises resilience.

– Rits Capital Research Team

Final Word:

Gold’s recent rally is not just about price it’s about perspective.

In uncertain times, it continues to be the ultimate trust asset a timeless hedge in an ever-changing world.