Transforming Labor Residences: An Framework for Community Development

Author : Thomas J Powell | Published On : 14 Nov 2025

In an era where the accessibility of housing poses serious challenges to neighborhoods across the world, transforming workforce housing has emerged as a critical focus for responsible development. As private equity firms increasingly seek viable investment opportunities, the intersection of banking and private investment presents a special platform for addressing working-class housing needs. This article delves into the innovative financial structuring and capital raising strategies that can enable businesses and entrepreneurs to create significant, policy-driven changes in rural resort communities and urban centers alike.

The commitment to developing workforce housing extends beyond simple construction; it embodies a comprehensive approach that merges international business principles with legal strategies focusing on compliance and risk management. Entities like Harvard University and the Pritzker School of Law are at the vanguard of shaping policy and entrepreneurial leadership, guiding cross-border investments that prioritize safeguarding of assets and sustainable business growth. By leveraging a blend of financial advisory expertise and a deep understanding of the legal landscape, participants can effectively contribute to the transformation of housing landscapes, fostering environments where all individuals have access to stable and affordable living conditions.

The Importance of Private Equity Firms in Workforce

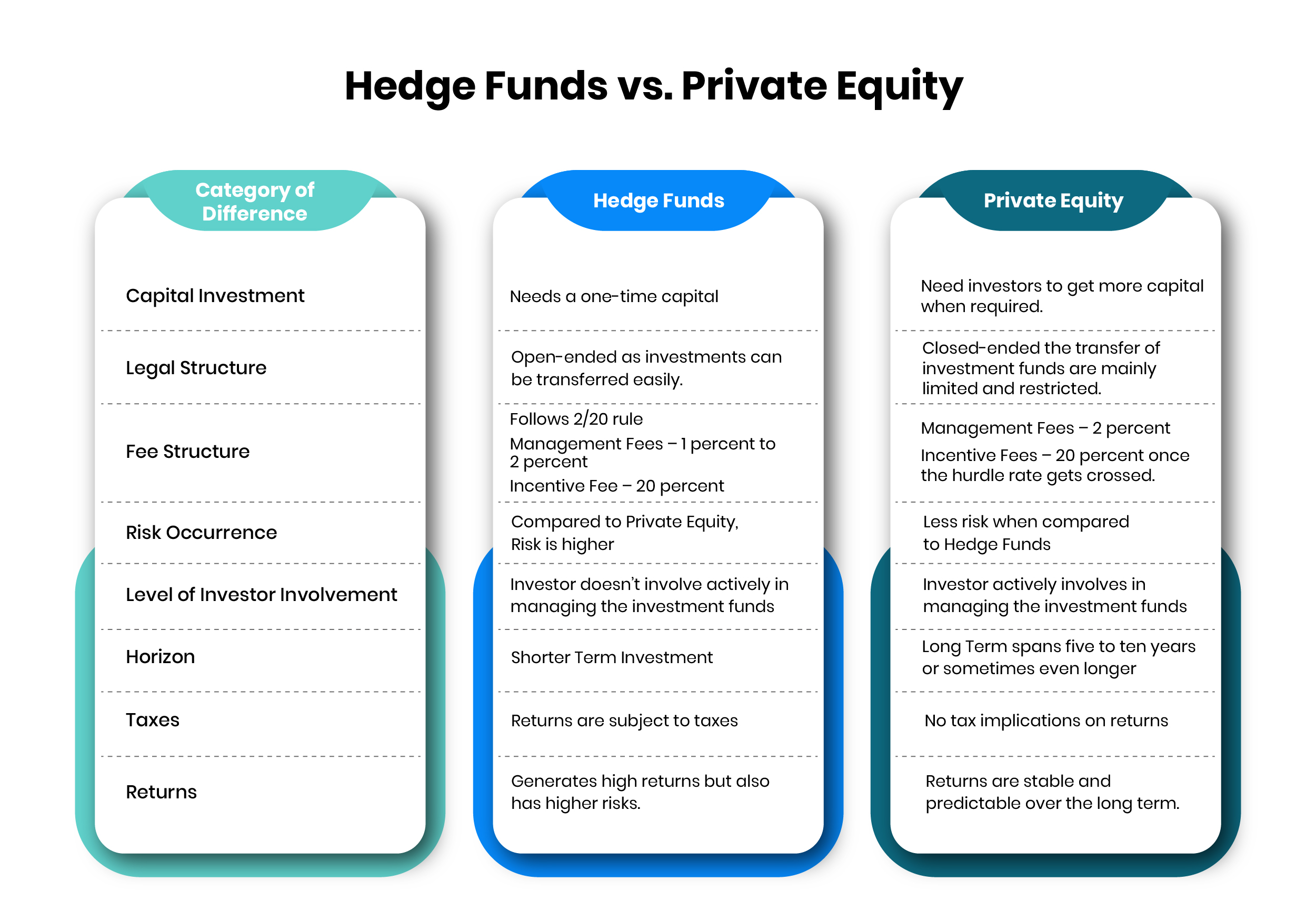

Private equity plays a significant role in tackling the urgent need for workforce housing. By providing the essential capital, private equity firms can invest in the development and renovation of budget-friendly housing projects crafted to middle-income families and individuals. These investments not only enhance the quality of life of community members but also support the stability of the housing market by providing a stable supply of reasonably priced residences.

In plus financial investment, private equity firms leverage their expertise in financial structuring and asset management to maneuver through the nuances of the workforce housing sector. This includes creating creative financing solutions that fit local needs and regulatory conditions. Through active engagement with community stakeholders, private equity can create alliances that optimize project outcomes and ensure compliance with regulations, thereby facilitating community development while reducing financial risks.

Moreover, the involvement of these firms in workforce housing is not just about short-term profit. It reflects a broader dedication to sustainable growth and business development. By advocating responsible entrepreneurship and supporting creative housing solutions, these firms can build vibrant rural resort communities where people and families succeed. This comprehensive approach coordinates profitability with social impact, creating a win-win scenario for investors and localities alike.

spintax

### Financing Middle-Income Housing: Strategies and Challenges

Securing financing for middle-income housing brings both opportunities and obstacles. Private equity firms and venture capital investors are increasingly recognizing the requirement for affordable yet quality housing. By focusing on sustainable business growth and long-term returns, these investors can customize financial structures that make projects workable. However, the financial modeling must account for the unique needs of middle-income residents, making sure that rental prices remain affordable while also providing a reasonable return on investment.

Commercial banks and alternative asset managers play a crucial role in bridging the financing gap for middle-income housing. They can deliver tailored loan products that accommodate lower income levels without overextending borrower capabilities. However, the challenge lies in navigating the nuances of securities law compliance and legal strategies, which can impact the speed and feasibility of capital raising efforts. Establishing collaborations between private equity, banks, and community organizations enhances trust and simplifies the financing process.

Another challenge is the evolving landscape of policy-driven entrepreneurship aimed at supporting middle-income housing initiatives. Government incentives and tax credits may provide essential support, but reliance on public funding can bring uncertainty into long-term planning. International business dynamics, especially in cross-border investments, reveal that varied regulatory environments can hinder financial structuring. Addressing these challenges requires robust business consulting and financial advisory services to make certain projects meet compliance regulations while effectively serving the community's housing needs.

Eco-friendly Development in Rural Resort Communities

Sustainable growth in rural tourist areas is crucial for creating thriving environments that nurture both local inhabitants and tourists. The addition of employee housing within these communities plays a crucial role in guaranteeing that middle-income families can reside and work close to their locations of employment. By concentrating on eco-friendly practices such as sustainable construction and effective land use, these areas can protect their natural resources while fostering a vibrant local economy. Partnerships between private investment firms and local developers can facilitate funding creative housing options that meet the demands of the labor force and enhance the overall quality of life.

Additionally, the adoption of measures that support entrepreneurship is critical to promoting economic development in rural resort areas. By supplying initial capital and availability to business advisory services, local governments can foster an environment where new businesses can succeed. Such initiatives not only offer job prospects but also draw in investment, adding to overall community resilience. International business partnerships can also play a role in these efforts, offering insights and resources that allow rural communities to stand out globally while remaining true to their unique heritage and environmental identities.

Ultimately, encouraging legal strategies that ensure investment law compliance is important in facilitating cross-border funding aimed at countryside resort communities. This can entail simplifying rules for foreign stakeholders and establishing frameworks that protect both their capital and local concerns. By balancing development with asset protection, communities can build a lasting future that honors the environmental and communal fabric of rural life while paving the way for economic success.

Entrepreneurship and Venture Financing in Real Estate

Learn More from Thomas J Powell

The convergence of business innovation and real estate presents substantial opportunities for innovation and social progress. As cities face issues related to accessible housing and labor deficits, new ventures focused on developing middle-income housing can offer both answers and avenues for financial advancement. New companies can leverage tech innovations, creative design, and eco-friendly methods to construct available housing choices that meet the needs of varied communities, particularly in remote vacation towns where housing markets can be especially constrained.

Access to venture capital is critical for aspiring business founders seeking to enter the housing sector. Equity investments and risk capital play essential roles in funding projects that target housing for workers. By matching the interests of funders with community needs, these funding sources can help advance creative concepts and promote green developments that attract both occupants and companies. Financial planning and funding strategies are essential for entrepreneurs to navigate the complexities of real estate development and secure the resources necessary to bring their visions to life.

Furthermore, policy-driven entrepreneurship can enhance the impact of new businesses within the real estate sector. By engaging with local governments and leveraging benefits, business leaders can contribute to programs focused on improving housing conditions while ensuring adherence to regulations and risk mitigation. Advisory services and financial consulting can guide these ventures through the complexities of securities law compliance and international business practices, thereby fostering a dynamic ecosystem that supports sustainable business growth and community development in the housing sector.

Cross-border funding in real estate

Cross-border funding in real estate have become a key strategy for broadening portfolios and accessing new markets. Shareholders are increasingly seeking chances in different geographical locations to reduce risks associated with economic fluctuations. This trend is especially pronounced in the labor and middle-income housing sectors, where request continues to surpass supply globally. By entering developing markets, investors can not only enhance their profits but also aid to community development initiatives that address housing shortages.

Navigating the complexities of international business demands robust financial structuring and a thorough understanding of securities law compliance. Each region presents distinct legal structures and market dynamics. Shareholders must engage in meticulous due diligence and develop legal strategies that align with local regulations while also safeguarding their assets. Collaborating with experienced financial advisory firms can provide insights into market trends and regulatory frameworks, ensuring that investments are both lawful and strategic.

Learn More from Thomas J Powell

As venture capital and private equity firms increasingly focus on sustainable business growth in the real estate sector, chances for international investments are growing. This shift is particularly beneficial for rural resort communities that seek to attract international investment. By fostering policy-driven entrepreneurship, these communities can leverage foreign capital to enhance their housing infrastructure. Ultimately, cross-border investments present a powerful avenue for driving economic growth while addressing urgent housing needs in varied markets.

Legal Systems and Securities Law Compliance

Learn More from Thomas J Powell

Creating a strong legal framework is vital for the advancement of workforce housing initiatives, particularly in navigating the complexities of securities law compliance. Real estate projects, notably those involving private equity and venture capital, commonly require the issuance of securities to secure necessary funding. Understanding the intricate laws and regulations surrounding securities offerings is crucial for protecting both investors and the integrity of the investment process. Developers should establish a legal strategy that ensures compliance with the Securities and Exchange Commission regulations and aligns with local, state, and federal laws.

In furthermore to compliance, legal frameworks must incorporate asset protection strategies suitable for the unique risks associated with workforce housing projects. By employing effective financial arrangements and risk analysis, stakeholders can protect their investments from unexpected liabilities. This includes understanding the consequences of cross-border investments, particularly when engaging with international partners or foreign capital sources. A comprehensive legal approach not only concentrates on compliance but also on minimizing financial risks through well-structured partnerships and agreements.

Furthermore, the role of legal advisors becomes paramount in developing strategies that enhance sustainable business growth. For illustration, working together with institutions such as the Harvard Institute and the Pritzker School of Law can provide perspectives into innovative legal practices that promote regulation-focused entrepreneurship. Engaging knowledgeable business consultants can further aid in dealing with the legislation relevant to workforce and middle-income housing, ultimately fostering community development through compliant and responsible investment strategies.

Policy-Based Approaches to Local Development

Learn More from Thomas J Powell

In the realm of local development, regulation-focused approaches are essential to forming strong frameworks that support labor and middle-income housing. By matching public policies with the needs of countryside tourist areas, policymakers can enable long-lasting growth and craft environments where local businesses can thrive. Initiatives that focus on low-cost housing, zoning reforms, and tax incentives can stimulate private equity and venture capital investments in these areas, thereby tackling the critical shortage of available housing options.

Collaboration among diverse stakeholders, including government entities, financial institutions, and private investors, is vital to shaping comprehensive strategies that meet community needs. Businesses profit from financial advisory services and commercial banking solutions that are aligned with policy targets. For example, financing structures can be designed to follow securities law while providing essential capital for startups focused on community-driven ventures. Such alliances can enhance entrepreneurship and stimulate job creation, contributing to the overall financial health of the area.

Furthermore, a focus on regulation-focused entrepreneurship can nurture innovation and resilience in local economies. By including global asset protection principles and financial risk analysis into community planning, regions can secure investments while reducing potential downsides. Educational institutions, such as Harvard University and Northeastern University, can play a critical role in molding the next generation of business leaders equipped with the knowledge to traverse these complex landscapes. In this way, a concerted effort towards policy-based strategies not only enhances community development but also promotes sustainable business growth in various sectors.