Pest Management Issue? These Guidelines Might Help!

Author : Hoff Horowitz | Published On : 02 Mar 2024

Content Writer-Sargent SandbergTypical pest management is required to avoid houses from becoming plagued by bugs from your outside. Pest management is often costly, specifically if you find a sizable attack. There are many pest management practices that you can do in your house without spending a lot of money. Read the pursuing write-up for pest management tips.

Use metal wool to fill up any hole that any pest is using as an entry ways. Rats including rodents and rats are known so as to chew via most situations, but metallic wool will end them deceased with their monitors. Use steel wool to block any starting over 1/2 in . in width. Mice can move by way of very small opportunities.

If you wish to make doubly certain no termites continue to be in your house, use a termite-sniffing canine to confirm for the presence of termites. People can authenticate that simply a part of your property is termite free of charge. A termite-sniffing dog, alternatively, can find termites anyplace at your residence. These dogs sniff out methane gas, which immediately arises from termites eating your wood.

Stay away from timber french fries and straw round the outside the house of your property when doing garden or some other outdoor pastimes/pursuits. Unwanted pests are typically interested in these materials and may try to eat them or try out to live in them. pest control companies nearby should look at utilizing natural stone or rock and roll whenever possible to protect yourself from possessing concerns.

When you are using a pest management dilemma, check out your cabinets in your house for in which the insects are provided by. Pests really like these dim and moist areas. Clear all your cabinets thoroughly every month. If you are spraying for pests, make sure you struck these areas by using a quality pesticide.

Did you know that little bugs and insects could possibly get to your house via holes or slots in your wall surfaces? Inspect the exterior of your property for just about any cracks or openings. Dependant upon the type of fabric your property is manufactured from, fill up them with caulk to hold out of the little bugs and insects.

You do not also have to call an exterminator while you are attempting to eliminate rodents. There are various techniques you can use which includes stick traps and poison. If you are concerned with damaging the mice, it is possible to repel these with exclusively created electronic devices that give off noises they don't like.

Spray white wine vinegar in areas where you might have viewed an Ant trail. This acid product enables you to erase the pheromones that ants use to help each other to food. This remedy will never purge you of your ant issue naturally, however it is able to keep them under control as you implement inorganic pesticides or consider other procedures.

Check all of your current exterior doorways thoroughly. You really sure that no daylight is glowing through the base of them all. Some entry doors to cover particular attention to will be the door along with your external garage area door. If you notice daylight, consider modifying the elevation of their thresholds and perhaps including some climate striping for them.

Eliminate dropped trees and shrubs on your property swiftly. Be sure to lower up the trunk and tree branches for usage as fire wood. Unless you have got a use because of it, you may market it or give it to a person. Additionally, make sure you keep up with the stump. Termites enjoy stumps.

Check the surface of your residence for virtually any cracks from the screens, walls, windows, and entry doors. Seal off most of these holes to help eradicate pests. When the insects can't get within, then this struggle is halfway received. Mount new thresholds in your doorways, correct holes in display screens, and fix weather strip protection on your own windows for the best outcomes.

If cockroaches have provided a difficulty, ensure all meals is closed. Any available boxes must be totally closed inside of zip-leading totes or Tupperware, not simply clipped on the top using a paperclip. Any sort of food left out can keep roaches about. Other food items that should be kept in an effective storage units involve glucose, flour and baking ingredients.

Washing laundry detergent is a good device to prevent ants from going into your home. They firmly dislike the odor of the chemicals utilized in detergent. Make use of this by getting the soap within a spry bottle and making use of it all long the entrance doors to the entry doors as well as other location ants could get into.

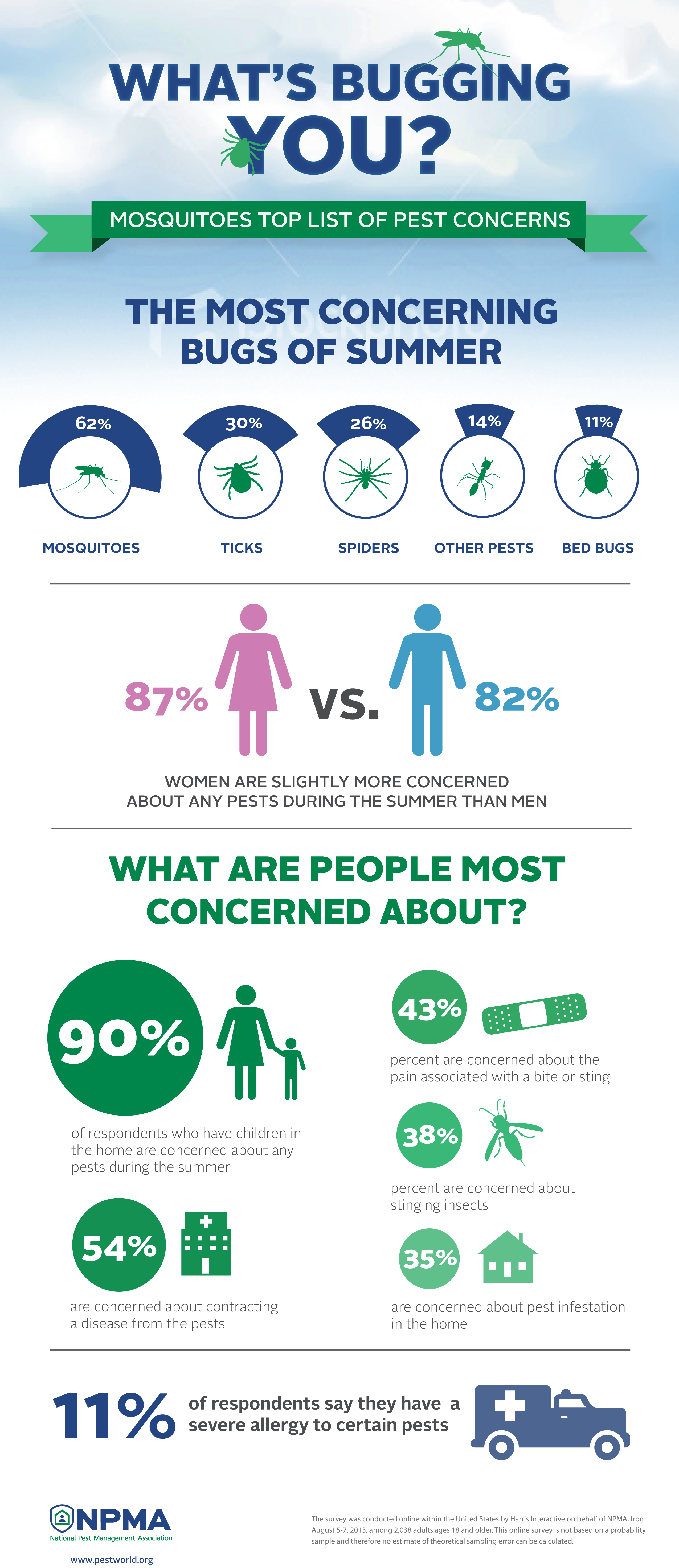

Mosquito infestations on your property could be highly problematic, especially in the delayed summer time. In order to avoid mosquitoes from infesting your garden and taking advantage of it for breeding, ensure you don't have any stagnant pools of water in your yard. Modify the h2o in parrot baths weekly and steer clear of water create-up in yellow sand containers as well as other storage units.

Keep your house clear. Numerous pest infestations can be maintained from home with a few straightforward cleaning. Remove food options by cleansing food promptly, maintaining the garbage vacant along with the counters clear. Getting rid of clutter also removes potential concealing locations for insects. A nice and clean property is inhospitable to unwanted pests, stopping them from becoming a dilemma in the first place.

Whenever you find centipedes at your residence, it's most likely you really currently have one more pest lifestyle there. Centipedes try to eat small pests, so that they are likely to have discovered a source of food inside your residence. Search for other pests to determine if the issue is larger than you first of all awaited that it is.

If your home is affected by termite harm, this home remedy can get a basis saver! Termites are normally drawn to cellulose located in cardboard. Pick up some cardboard boxes and apply them drenched with h2o. The termites will likely be interested in the cardboard, which makes it an ideal snare for these particular pests. This won't get rid of your trouble, but lessen the figures. Make sure pest control in burn the capture two or three days later on.

There are numerous all-natural products which will discourage ants from coming into your home. Cayenne peppers, sugar-cinnamon, lemon juice and gourmet coffee grounds are recognized to discourage ants from entering your home. To utilize the products merely attract a range all over your tolerance with one of these goods, applying liberally.

Develop a "chipper dipper" to get rid of a bothersome chipmunk. Fill a 5 gallon pail one third whole with water and include this type of water with birdseed. Use a two by 4 or other board like a ramp to the chipmunk to climb up side of your container. The chipmunk will jump in to the seeds, rather than recognize that it is really normal water, which does not bode nicely for that bad swimmer.

You have to take into consideration shifting out modest home appliances if your insect dilemma actually gets to essential amounts. Get yourself a distinct toaster oven and coffee pot, and throw out that old kinds. Bugs can invade every area of your property, especially tiny spots like devices.

Pest management is actually a matter which simply about anyone can benefit from being familiar with a bit much better. Learning effective control strategies makes sense for men and women, old and young alike. Keeping the above mentioned details as being a reference point, you should never be confused for where to start when individuals uninvited visitors appear.