Choosing To Go through Aesthetic Surgery: What You Ought To Know Very first

Author : Clay Sanford | Published On : 06 Jan 2024

Web Content Produce By-Ewing MontoyaSo something concerning your entire body has been bothering you for many years. You will be now on the fence as to whether, or not you want to do one thing about it. Spend some time to read the subsequent report to acquire some thoughts concerning the do's, and don'ts about cosmetic plastic surgery.

When examining any kind of plastic surgery, you should be sure to shop around. Individuals who undertake surgical treatment with out initial doing so are usually very likely to suffer from a bad-top quality physician. Talk to a minimum of 4 to 5 pros just before shutting your surgical treatment in order to ensure quality.

To ensure your plastic procedure is being being carried out from a trained specialist, investigate the doctor's background. Discover in which these people were educated. What sorts of licenses, and certification they may have. Any extra training they may have been through, and when you can find any data of which with your local Department of Health. Also, request the physician how frequently they've accomplished the process you need.

Before experiencing cosmetic surgery, be sure your doctor is actually a doctor. You desire a board-licensed surgeon focusing on you, not much of a specialized medical practitioner. Check if the operating specialist has table accreditations. Check with the licensing body, to make sure the doctor is certified. Safer to be secure than sorry!

Check out whether, or otherwise the surgeon you are interested in is prosecuted for malpractice. You may use internet resources to determine whether, or not any statements happen to be made. Understanding their history makes it much simpler to help make an informed selection about whether, or perhaps not you desire somebody to perform your surgical procedure. check out here have to be believe of anyone with a number of malpractice matches.

There are lots of instances in your life when conserving money is an integral part of a acquiring determination, nonetheless, aesthetic or plastic cosmetic surgery will not be one of these brilliant instances. This does not necessarily mean that you need the highest priced operating specialist possible, however you probably want to prevent budget plastic surgery too.

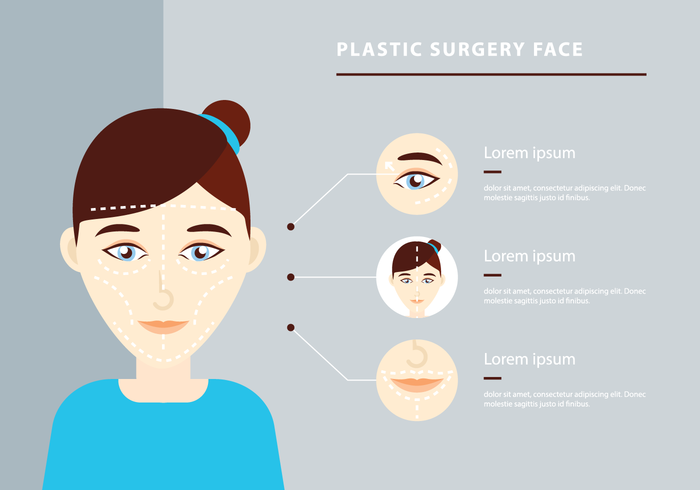

Rhinoplasty is a surgical treatment that reshapes the nose. This surgery is practically the most common cosmetic plastic surgery. The operating specialist makes the nasal area even bigger or smaller or completely alterations the design in the bridge or the tip of the nostrils. It might correct a personal injury, a delivery deficiency or perhaps a respiration issue.

Prior to getting surgical treatment, remember that there may be complications from your treatment. Your plastic surgeon will probably review these probable difficulties together with you. It is important for yourself to pay attention to them. A few of the complications can include illness, irritation, greater hypertension, and though unusual, even dying.

Prior to making the exact scheduled appointment for having cosmetic plastic surgery, ensure you check out qualifications. Very much like you wouldn't go to a medical professional that isn't respected, you need to stay away from visiting a medical center if you do not have specifics of it. This ought to incorporate research into the standing of the service, their devices and any previous troubles they will often have seen.

Liposuction treatment is a well-liked plastic procedure. A tube is placed in through a small lower after which suction power body fat out. The tubing goes into excess fat level, and it also functions to dislodge unwanted fat tissues and vacuum cleaners them out. A doctor could use a big syringe or perhaps a vacuum pump.

Even though cosmetic plastic surgery is now more common, there are still certain threats related to these methods. Just like any other surgical procedures, anesthesia, that is utilized to sedate, you in the method, positions a significant chance. Do your homework before your surgery to discover what kind of sedation is going to be applied.

Check with your plastic surgeon to see before and after pictures of patients, they have got executed surgical procedures on prior to. By doing this, you can observe the type of function they actually do and decide if it doctor meets your needs. If you do not like what you see from the pictures, pay a visit to yet another doctor.

If you want to have surgical treatment, you need to examine all of the possible unwanted effects first. You will always find dangers engaged once you have surgical treatment, and getting cosmetic surgery is no distinct. The only way to make a well informed determination is to be aware what you could expect and what might take place.

Watch out for doctors who advertise themselves as "board accredited", but will not establish what table. Any licensed medical professional can officially conduct aesthetic surgery, even without the need of certification from your Board of Plastic Cosmetic Surgery. They might be Board-accredited in one more area, entirely not related to plastic-type material, or surgical treatment. Ask for certification essentials.

Check out the negligence history of any surgeon you are thinking about. While most doctors experienced negligence claims submitted against them, will not handle any doctor who may have an too much sum. That would be a confident way to put your daily life at an increased risk. It is really not worth it since, there are numerous other surgeons to choose from.

When of your own plastic process, dress in comfortable garments for the hospital or doctor's business office. Maybe you are gonna be really sore in case you have your method carried out and the final thing for you to do is try and press into limited clothes. Rather than denims along with a restricted tshirt, use sweating jeans as well as a loose aquarium leading.

Put together a list of inquiries. There will definitely be a appointment before surgical procedures in which your medical professional talks about the procedure along with you, along with what you are interested in in your effects. Ready yourself by familiarizing your self with your procedure ahead of time, and make a listing of concerns to your medical doctor.

If the expense of the surgical treatment is bothersome, look at online reductions in price for surgical treatment. There are far more and more websites, for instance Groupon, offering special discounts, especially on eye and lip processes. Ensure that you completely browse the discount restrictions just before utilizing or purchasing it. Make sure you are eligible for the voucher. The vast majority of time the savings are merely open to customers, or there are additional limitations.

Do ask http://carecredit.com/doctor-locator/Cosmetic-Surgery-in-MANSFIELD-TX-76063/Mansfield-Cosmetic-Surgery-Center if the cosmetic surgery you are thinking about will work the potential risk of scarring, or contamination. Some surgeries are always going to keep a scar tissue. Even though occasionally, the scar tissue might be preferable to the current truth. Usually examine the risk of contamination. Also, consider how hazardous the possible infection could be.

We want to seem our very best and in some cases we wish to make modifications to the physiques employing cosmetic plastic surgery to do this goal. Surgical treatment can assist you look more youthful, thin, as well as feel more confident. Figure out all your options to ensure you are making a appropriate selection about switching your appearance.