Navigating Retirement: Specialist Tactics from Pioneer Finances

Author : Curtis Edmark | Published On : 10 Oct 2025

As you near retirement, the experience might feel challenging. Various inquiries come to mind: Is my savings adequate? How do I plan for my income? What tactics should I use to secure my financial well-being during these prosperous years? This is where expert guidance from Pioneer Financial Group becomes invaluable. With their vast expertise in retirement planning and financial services, they focus on guiding you through this vital period of your life with assurance.

Pioneer Financial Group is known for a well-rounded method of wealth management focused on personalized strategies that cater to your specific needs. From maximizing Social Security benefits to handling IRA and 401(k) rollovers, their qualified advisors, skilled in investment strategies and risk management, are here to ensure your retirement is not only comfortable but also financially secure. With a strong emphasis on client empowerment and regular financial assessments, you can develop a sound plan that provides guaranteed income and inflation protection, enabling you to fully enjoy your retirement.

Grasping Post-Employment Preparation

Retirement planning is a vital aspect of financial stability that includes a holistic approach to overseeing your financial resources as you shift into retirement. It requires careful consideration of various components, including your current financial situation, expected earnings, and long-term targets. Engaging with a financial consultant, such as those from Pioneer Financial Services, can provide the insight needed to develop a customized retirement plan that matches with your desires.

A critical component of retirement planning is understanding diverse pension income sources, such as government benefits, pensions, and personal savings. It’s important to enhance these sources to ensure a reliable income flow during your retirement years. Tactics like enhancing Social Security benefits and Individual Retirement Account or 401(k) transfers can significantly affect your complete financial outlook, allowing you to enhance retirement income and guarantee you’re protected against unexpected expenses.

Additionally, managing risk and diversification of investments play critical roles in a effective retirement approach. Utilizing a mix of financial products like financial annuities, pooled funds, and life cover, along with frequent semi-annual assessments, can help manage risk and opportunity for growth. By evaluating your risk tolerance and developing knowledgeable investment strategies, you can create a retirement strategy that not only satisfies your needs but also shields you against inflation and market volatility.

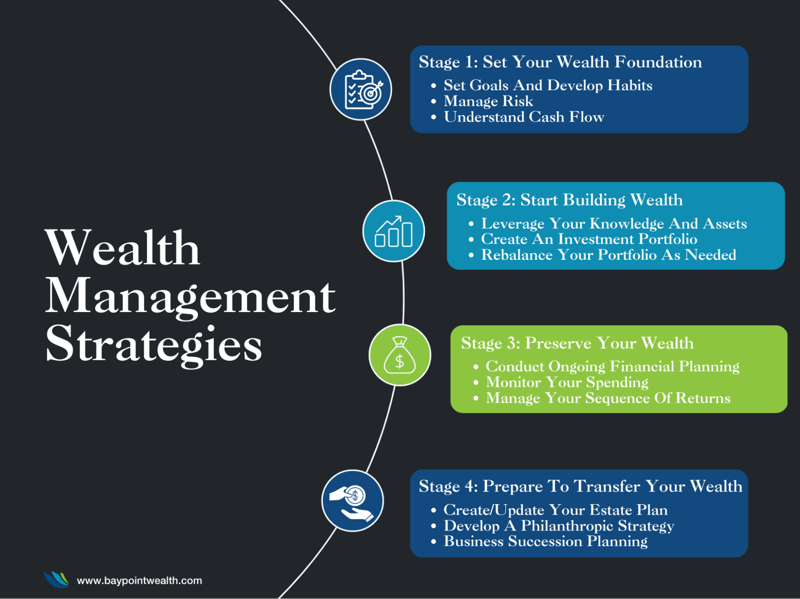

Strategies for Wealth Management

Successful financial management is key for reaching sustainable economic targets, particularly individuals near the retirement phase. The Pioneer Group stresses a full-spectrum approach including multiple financial planning tools designed for unique requirements. This involves investing in a varied portfolio of investment funds and stocks, which can enhance the potential for growth while controlling risk. Through the use of sophisticated investment strategies, financial advisors aim to synchronize clients’ monetary goals with their individual tolerance for risk, guaranteeing a balance that fosters a combination of safety and advancement.

Additionally, leveraging options such as variable annuities and life insurance can provide retirees with guaranteed income streams which are crucial in preserving economic stability throughout retirement. This approach not only aids to reduce the threat that comes with market volatility but further tackles concerns regarding protection from inflation. Pioneering these strategies, Pioneer Financial Group empowers clients to make informed decisions, emphasizing optimizing gains while protecting their wealth for those to come.

Client learning plays a key position in the financial management process. The financial services veterans at Pioneer Financial are dedicated to informing their clients regarding the multiple financial products that are available, comprising health insurance options that are important to managing medical expenses in the retirement phase. Through biannual financial reviews, advisors confirm that clients stay informed and ready for any shifts in their financial situation, thus bolstering their capacity to handle the retirement journey with clarity.

Role of Financial Advisors

Learn More from Curtis Edmark

Investment advisors play a vital role in handling the challenges of retirement planning. They offer tailored strategies to match clients' investment objectives with their individual circumstances, aiding individuals determine their risk tolerance and investment preferences. With a broad base of knowledge in financial products, including investment funds, structured settlements, and securities, these advisors enable retirees to make informed decisions about their portfolios. Additionally, they are instrumental in enhancing Social Security benefits, making sure individuals can maximize their retirement income.

A significant aspect of a financial advisor's role involves conducting thorough assessments of a client's current financial situation. This includes evaluating existing retirement accounts such as 401(k)s and IRA accounts, giving guidance on shifts, and exploring options for guaranteed income streams. By addressing concerns such as inflation protection and asset diversification, advisors can create holistic investment strategies that correspond with future financial objectives. Their expertise in risk reduction further helps clients steer clear of common pitfalls, allowing them to face retirement with assurance.

Additionally, financial advisors foster ongoing client education through semi-annual financial reviews and consultations. This strategy not only builds trust but also guarantees that clients remain updated about changes in the financial landscape that may impact their retirement plans. With certifications such as Series 7 and Series 66, licensed advisors are expertly prepared to provide insights and strategies that adjust to evolving market conditions. At the conclusion, their support is crucial for retirees wishing to secure their financial futures and reach sustained peace of mind.

Investment Strategies for Individuals in Retirement

Learn More from Curtis Edmark

As retirees move into a fixed income phase, selecting the best investment options becomes essential for maintaining financial stability. A varied portfolio can help lessen risks and provide a form of assured income. Common investments include annuities, which offer scheduled payouts tailored to specific needs, and pooled funds, which enable retirees to invest in a combination of shares and bonds administered by professionals. This method not only diversifies risk across different asset classes but also offers prospective growth to keep pace with inflation.

In addition to traditional investments, retirees often explore lifelong insurance and health insurance products as part of their financial planning approach. Life insurance can provide beneficiaries with monetary safety, while specific health insurance plans may address long-term care needs. Grasping these products is essential for successful retirement planning, as they can shield against unexpected expenses and ensure that the retiree's financial legacy is secured.

Social Security benefits optimization and calculated IRA or 401(k) transfers are also vital considerations. A financial advisor can help in navigating these options to maximize retirement income. Taking the time to assess each investment strategy based on specific risk tolerance and financial goals can lead to a more stable retirement. Regular evaluations and changes to the portfolio will help ensure that retirees continue on track to meet their financial objectives.

Challenge Mitigation Strategies

One of the essential aspects of monetary planning is effectively managing danger to ensure a consistent retirement income. Pioneer Finance emphasizes a broad investment approach that allocates assets across multiple financial products, including mutual funds, stocks, and annuities. This strategy helps mitigate the impact of financial volatility, allowing retirees to sustain their financial stability. By opting for a diversity of assets that perform differently under varying market conditions, clients can lessen potential detriments while maximizing their growth potential.

Another vital strategy consists of the enhancement of Social Security benefits. A skilled financial advisor can assist retirees in maneuvering through the intricacies of claiming Social Security. By evaluating individual circumstances and scheduling claims correctly, clients may enhance their lifetime benefits significantly. This forward-thinking approach not only enhances fixed income but also reinforces overall retirement planning, ensuring that retirees have a solid foundation to maintain their lifestyle.

Learn More from Curtis Edmark

Furthermore, Pioneer Financial Group advocates for frequent financial reviews to adjust strategies as market conditions or personal situations change. Twice yearly financial reviews allow clients to reassess their risk tolerance and make thoughtful decisions regarding their portfolio decisions. This continuous client education helps retirees keep updated about potential risks and gives them reassurance as they face life's changes, such as medical expenses or changes in income requirements. By prioritizing these techniques, retirees are more prepared to ensure a solid financial future.

Enhancing Social Security Benefits

Optimizing your Social Security entitlements is a essential aspect of planning for retirement that can significantly enhance your overall financial health. Understanding the best age to start receiving benefits is important; while you can begin receiving Social Security at 62, postponing it until your full retirement age or even 70 can lead to increased monthly payments. For many retirees, analyzing their unique circumstances, such as health condition and life expectancy, aids establish the optimal strategy for claiming benefits.

Another important consideration is coordinating Social Security benefits with additional retirement income sources. For instance, withdrawals from IRAs or 401(k)s can affect your Social Security taxation. By intelligently withdrawing from these funds, you may minimize your total taxable income and enhance your net benefits. Consulting with a financial planner who specializes in Social Security strategies can offer personalized plans tailored to your financial situation.

Moreover, spousal and beneficiary benefits should not be overlooked. Married individuals have the ability to plan their claims to maximize their combined benefits, as one spouse can receive a spousal benefit based on the spouse's record of earnings. This approach can result in a substantial increase in total household income during the retirement years. Working with an knowledgeable financial advisor will help you make wise decisions that support your long-term financial goals.

The Value of Regular Financial Assessments

Consistent financial reviews are vital for guaranteeing that your retirement strategy remains on track. As the economic environment shifts, so do your personal circumstances and financial goals. Participating in semi-annual financial reviews allows you to evaluate your existing strategies, modify as needed, and address any emerging risks that could impact your retirement income. This proactive approach not just helps in maintaining alignment with your objectives but also boosts confidence in your wealth management efforts.

Learn More from Curtis Edmark

Another key aspect of these reviews is the opportunity to optimize your investment strategies. With volatile markets and developing financial products, your portfolio may need rebalancing to guarantee optimal performance and diversification. A licensed advisor, knowledgeable in securities and mutual funds, can assist you understand your risk tolerance and choose the appropriate mix of investment options. This careful evaluation can lead to better returns and enhanced inflation protection for your retirement savings.

In conclusion, regular financial reviews facilitate ongoing client education. As you receive insights on life insurance, health insurance, annuities, and other financial products, you become more empowered in handling your finances. Working closely with a financial advisor, particularly those connected to reputable firms like Pioneer Financial Group or Centaurus Financial, makes certain that you are armed with the knowledge needed to make informed decisions. In the end, these reviews serve as a basis of sound retirement planning, helping retirees to steer through their financial futures with clarity and assurance.